34+ ppp loan forgiveness letter sample

Id be glad provide you some update bendor1126. Restaurants and other hospitality businesses may multiply those costs by 35x making them eligible.

Explore Our Printable Personal Loan Receipt Template Contract Template Personal Loans Statement Template

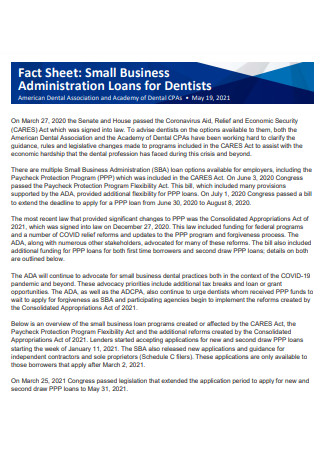

Under the Act any amount of cancelled debt associated with the PPP loan that would otherwise be includable in the gross income of the borrower under the Internal Revenue.

. This form may be used for both first and second draw PPP loans regardless of when you got your PPP loan as long as it has not yet been forgiven. So as the man said. Correction of errors 110 44.

Nonprofit PPP Loan forgiveness How Does it Work. So dont trust experts who say dont worry about getting the loan forgiven. They creat a loan request application in your name that which is sent to the SBA after your approval.

Significant accounting policies 111 45. 2 2020 the US. But since our advice is to always move to the next step in this case Loan Forgiveness.

In order to have your PPP loan forgiven you are required to submit the Loan Forgiveness Calculation Form and Schedule A to us as well as supporting documentation described in Exhibit A found below. Based on the guidance issued from the regulators if you received a SBA loan number the application is considered completed. The IRS today announced that it is sending letters to taxpayers that have experienced a delay in the process of Form 7200 Advance Payment of Employer Credits Due To COVID-19.

This sample engagement letter is to be used when assisting a client with the assembly of their PPP Loan Application. Relief for mortgage loans lease arrangements of certain trusts COVID-19. Was ineligible for the PPP loan amount received or used the PPP loan proceeds for unauthorized uses.

Basis of measurement 109 43. Additionally employee salaries are 30 below. We support companies that have 5-50 employees to supplement or replace your accounting and finance department for a fraction of the cost.

If you are approved the request is sent back to the entity that made the request for you. The information is produced and provided by CNA. Acquisition of NCI 100 Other information 101 36.

But forgiveness is divine. Is ineligible for PPP loan forgiveness in the amount determined by the lender in its full approval or partial approval decision issued to SBA. Youve used the full amount of your first PPP loan before the second loan is disbursed.

Subsequent events 108 Accounting policies 109 42. Paycheck Protection Program Loan Forgiveness andor. PPP Loan Application Assistance Services.

First Draw PPP loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement. Heres what weve learned so far. What payroll taxes are included in the PPP loan forgiveness.

Is ineligible for PPP loan forgiveness in any amount. Related parties 105 41. So either the application was withdrawn or it was approved but not accepted.

PPP Loans and Adverse Action - 050820 0447 PM. Congratulations on navigating the PPP process. The borrower files a Forgiveness Application.

Beyond the ease of qualifying and low interest rates perhaps the most attractive feature of Paycheck Protection Program PPP loans is that they are eligible for forgiveness. During the eight-week period following loan funding your business spends 75000 on payroll costs making it eligible for up to 100000 in forgiveness. If you run payroll manually you might create a payroll report in Excel.

SBA Part Thirty. Attention All PPP Borrowers with 2 Million or More in PPP Loans The SBA Revisited Its Famous Loan Necessity FAQ Once Again and You May Not Be Happy About It 11320 SBA Part Twenty-Nine. As outlined in the Forgiveness Application borrowers are expected to gather the necessary.

PPP borrowers could use the 8-week-covered period if they received their loan prior to enactment June 5 2020. While this guidance was released to all SBA employees and PPP lenders it is relevant for PPP borrowers looking to undergo a change of ownership as well as for buyers and sellers. Employee and compensation levels are maintained The loan proceeds are spent on payroll costs and other eligible expenses and.

I am not that familiar with the logistical process. PPP loan forgiveness services matrix As of May 27 2020 What CPA service is being provided for. Loan covenant waiver 101 37.

1 PPP Loan Forgiveness Application pdf 2 PPP Loan Forgiveness Tracking Template xls 3 PPP Loan Forgiveness Video Update mp4 As we shared with you on Saturday the SBA issued the Loan Forgiveness Application on May 15th that will be used by PPP borrowers to determine and report how much of their PPP loan will be forgiven. 1 PPP loan forgiveness services matrix The sample engagement letter is being provided courtesy of the AICPA Member Insurance Program and you will be directed to a different site. 116-142 the Paycheck Protection Program Flexibility Act among other provisions extendedthe PPP loan forgiveness covered period from 8 weeks after the loans origination date to the earlier of 24 weeks or December 31 2020.

Sba and ppp forgiveness consulting services engagement letter McGowan Program Administrators strives to stay on top of current issues in the accounting industry and share relevant information that will assist our clients and insurds to minimize their exposure when providing professional services. Operating leases 102 38. Is based on Inside Charitys direct communications with the Small Business Administration and multiple financial lenders.

Payments for employer state and local taxes paid by the borrower and assessed on S corporation owner-employee compensation is eligible for loan forgiveness as are employer retirement contributions to owner-employee retirement plans capped at the amount of 2512 of the 2019 employer. Your number of full-time employees is down by 50 with no plans to rehire which may reduce the forgiveness amount by 50 to 50000. These sample engagement letters are to be used when performing Paycheck Protection Program PPP loan consulting engagements.

The latest and simplest form is 3508S and it may be used for loans of 150000 or less. Borrowers may receive a loan amount of up to 25x the average monthly payroll costs in the one year prior to the loan or the calendar year up to 2 million. If you submit to your loan forgiveness application within 10 months after the end of your loan forgiveness covered period you will not have to make any payments of principal or interest on your loan before the date on which SBA remits the loan forgiveness amount on your loan to your lender or notifies your lender that no.

Was ineligible for a PPP loan. It may be easiest to begin. A company requiring 100000 in PPP loans would have to pay the bank 4200 per month over 24 months at 1 percent interest to settle the loan.

Bank doesnt accept QBO Payroll as Third Party Payroll Provider for Reports in PPP Loan Forgiveness. Small Business Administration SBA released a long-anticipated Procedural Notice related to changes of ownership in an entity that has received a Paycheck Protection Program PPP loan. There are currently three forgiveness forms.

Borrowing for PPP is easy. The lender or middle man compiles your documentation identity checks bank account info etc. SBA Forgiveness Decisions Begin and Forgiveness for PPP Loans Under 50000 Made Simpler 101220.

If you have a PPP loan get organized now. CARES Act provides loan forgiveness to small businesses for certain loans made pursuant to the PPP under the Small Business Act. PPP loan-forgiveness application forms COVID-19.

The SBA will either approve or deny your loan request. At least 60 of the proceeds are spent on payroll costs.

Tech Wallpapers Flowers Pink Peonies Bouquet Beautiful Flowers

Certificat Origine Chine Sino Shipping Certificate Of Origin Certificate Professional Templates

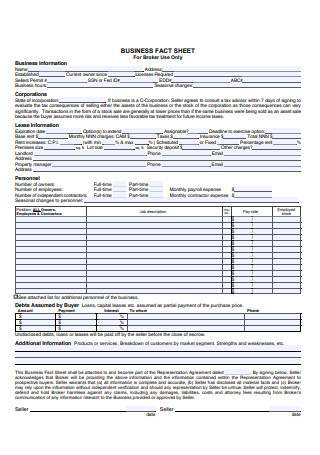

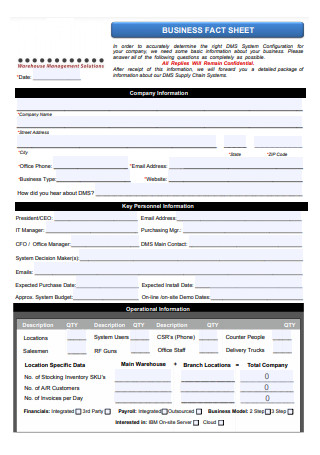

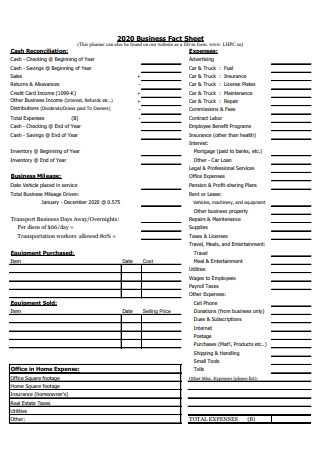

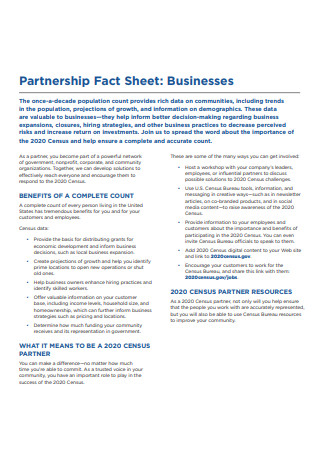

34 Sample Business Fact Sheet In Pdf

Fence Invoice Fence Estimate Template Estimate Template Proposal Templates Business Proposal Template

34 Sample Business Fact Sheet In Pdf

34 Sample Business Fact Sheet In Pdf

34 Sample Business Fact Sheet In Pdf

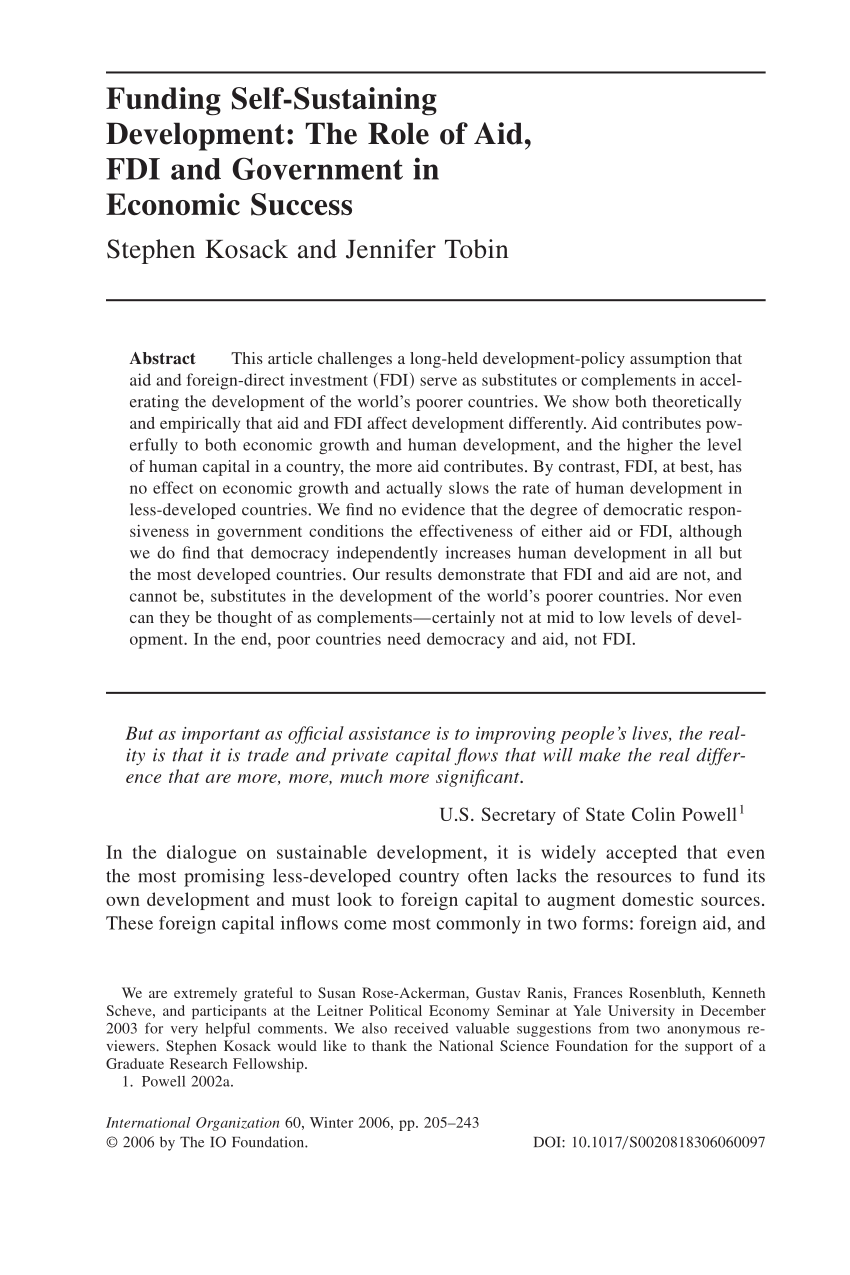

Pdf Funding Self Sustaining Development The Role Of Aid Fdi And Government In Economic Success

Https Irsprob Com Irsprob Com Wins Again 2 Internal Revenue Service Cpa Irs

Pdf Funding Self Sustaining Development The Role Of Aid Fdi And Government In Economic Success

College Comparison Template For Excel Suggested Addresses For Scholarship Details Scholarshipy

34 Sample Business Fact Sheet In Pdf

Bank Of America Bank Wire Address Seven Things You Should Know Before Embarking On Bank Of A Business Letter Template Letter Example Formal Business Letter

34 Sample Business Fact Sheet In Pdf

34 Sample Business Fact Sheet In Pdf

Hospital Organizational Chart Examples Lovely Image Result For Organizational Chart For Assisted Living Business T In 2021 Business Template Best Templates Templates

Pdf Funding Self Sustaining Development The Role Of Aid Fdi And Government In Economic Success

Personnel File What To Include Not Include Checklist Checklist Template Checklist Career Planning