17+ Subprime mortgage

All You Need to Take the Best Mortgage Loan For You. Banks losses were forecast to hit 1 trillion and European bank losses will reach 16 trillion.

Securitization Mortgage Backed Securities Collateralized Debt Obligations And Credit Default Swaps Mortgage Loans Refinance Mortgage Mortgage

A subprime fixed-rate mortgage works just like a conventional fixed-rate mortgage in that the borrower gets a set interest rate and the monthly payment remains the same for the length of.

. These purpose of originating these loans was to collect fees and then sell these. Easily Compare Lenders Choose Today. Page 17 of 50 - About 500 Essays Better Essays.

Credit score the size of the down payment the number of late payment delinquencies. All You Need to Take the Best Mortgage Loan For You. Prime mortgages can be either fixed or adjustable rate loans.

Easily Compare Lenders Choose Today. In most cases people with a credit score below. A subprime mortgage is a type of mortgage that is given to people with a poor credit history typically below 620.

The subprime mortgage crisis of 200710 stemmed from an earlier expansion of mortgage credit including to borrowers who previously would have had difficulty getting. Heres what that looks like compared to. Subprime mortgage originators were frequently owned or controlled by major financial institutions.

These mortgages allow less-creditworthy borrowers to buy a home but they. A subprime mortgage is an alternative offered to borrowers with low credit scores or other credit issues that disqualify them for a conventional mortgage. Banks were about 6.

A Major Cause for the Financial Crisis of. What is Subprime Mortgage. A Major Cause for the Financial Crisis of 2008.

The interest rates on subprime mortgages on the other hand are much higher as high as 8 percent or 10 percent. What Is a Subprime Mortgage. The IMF estimated that US.

Ad Mortgage Loan Low APR Top Lenders Comparison Free Online Offers. The rapid rise and subsequent fall of the subprime mortgage market is therefore reminiscent of a classic lending boom-bust scenario3 The origin of the subprime. The expansion of subprime mortgage lending has made homeownership possible for households that in the past might not have qualified for a mortgage and has thereby.

Instead of taking an installment. As housing prices fell and interest rates rose homeowners unable to pay. Ad Mortgage Loan Low APR Top Lenders Comparison Free Online Offers.

A subprime mortgage is generally a. Lenders often ask for a higher down payment too such as 25. The subprime mortgage crisis was a multi-year multinational event sparked by the US.

Crisis after the immense gloom in 1930 s has been the Global Financial Crisis of 2007-08 which activated from the Subprime Mortgage emergency. More often subprime mortgage loans are adjustable rate mortgages ARMs. A subprime mortgage is a type of loan given to borrowers who dont qualify for a traditional prime mortgage.

How Much More Is a Subprime Mortgage. A subprime mortgage comes with higher interest rates and is given to borrowers with poor credit. The International Monetary Fund estimated that large US.

A subprime mortgage is a type of debt instrument that is provided to individuals with a low credit score and whose chances of paying back the loan are lower than other. A subprime mortgage can cost hundreds of thousands of dollars more than a conventional loan. The interest rate associated with a subprime mortgage is dependent on four factors.

And European banks lost more than 1 trillion on toxic assets and from bad loans from January 2007 to September 2009. Page 17 of 50 - About 500 Essays. These losses were expected to top 28 trillion from 2007 to 2010.

The Most Dangerous Bank In America Market Mad House Subprime Mortgage Subprime Mortgage Crisis Credit Default Swap

2

Identifying And Trading A Bear Market

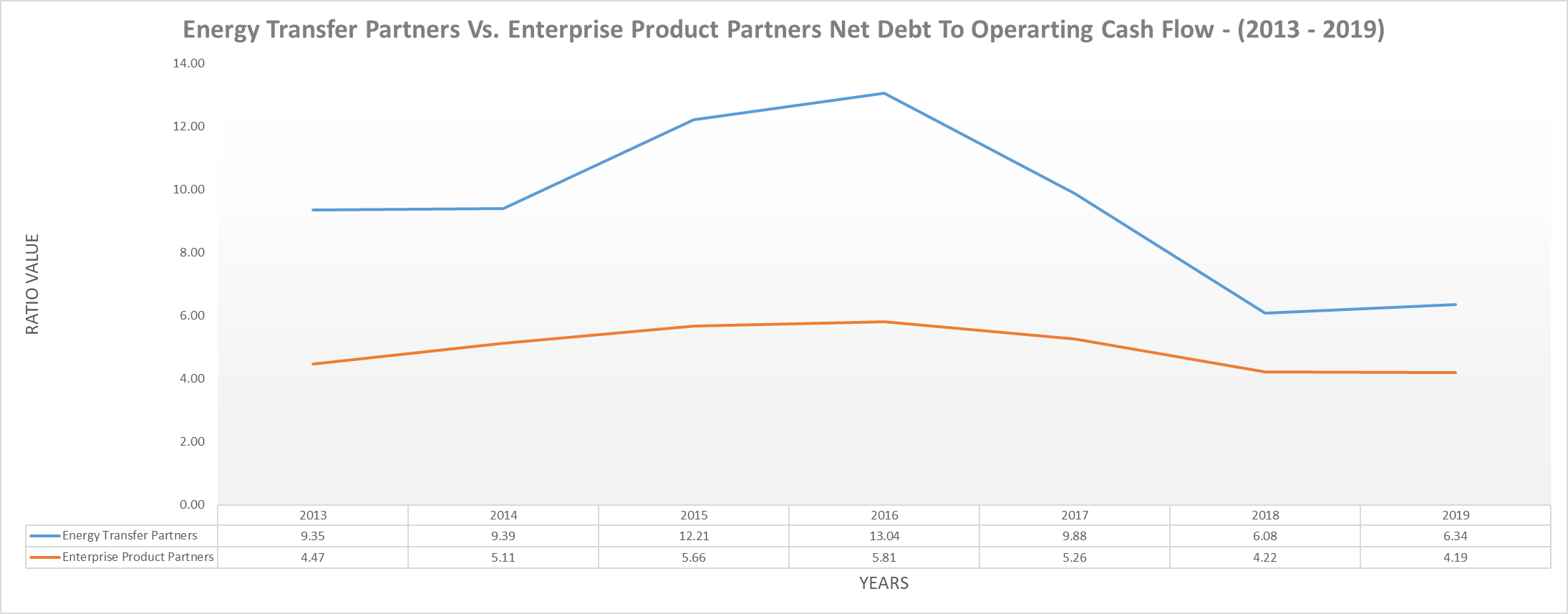

Energy Transfer Vs Enterprise Products Partners One Offers Superior Value Nyse Epd Seeking Alpha

Identifying And Trading A Bear Market

Identifying And Trading A Bear Market

American Homes Underwater Subprime Mortgage Crisis Jenns Blah Blah Blog Subprime Mortgage Crisis Mortgage Underwater

Under The Hood Of A Remic Subprime Mortgage Subprime Mortgage Crisis Mortgage Info

Identifying And Trading A Bear Market

Identifying And Trading A Bear Market

Casualties Of The Financial Crisis Subprime Mortgage Crisis Financial Financial Services

2

Identifying And Trading A Bear Market

Identifying And Trading A Bear Market

The Most Dangerous Bank In America Market Mad House Subprime Mortgage Subprime Mortgage Crisis Credit Default Swap

How Did The Abx Index Behave During The 2008 Subprime Mortgage Crisis Subprime Mortgage Crisis Stock Analysis Earnings

International Financial Markets Springerlink